Forms 1120-S, 1065, and 1042 are due by March 17, 2025. Request an Extension Now

Business Tax Extension Form 7004 - An Overview

Form 7004 is used by businesses to request an automatic 6 months extension of time to file business income tax returns.

- C corporations

- S corporations

- Partnerships

- Multi-member LLCs

- Certain estates and trusts

IRS grants you the automatic extension if you File before the actual business tax filing due date and pay any balance taxes that are due, if applicable.

Note: IRS Form 7004 does not extend the time of payment for taxes.

Need more time to file your Business Income Tax Return?

Request an Extension NowDeadline to file your Business Tax Extension Form 7004

The deadline to file Form 7004 depends on the original due date of your business tax return.

To avoid penalties and interest, businesses must estimate and pay their taxes by the original deadline.

| Form 7004 Filing Deadlines | ||

|---|---|---|

| 15th day of 3rd Month after the tax period ends | 15th day of the 4th month after the tax period ends | |

|

|

|

Use our calculator to find the due date to file your Form 7004.

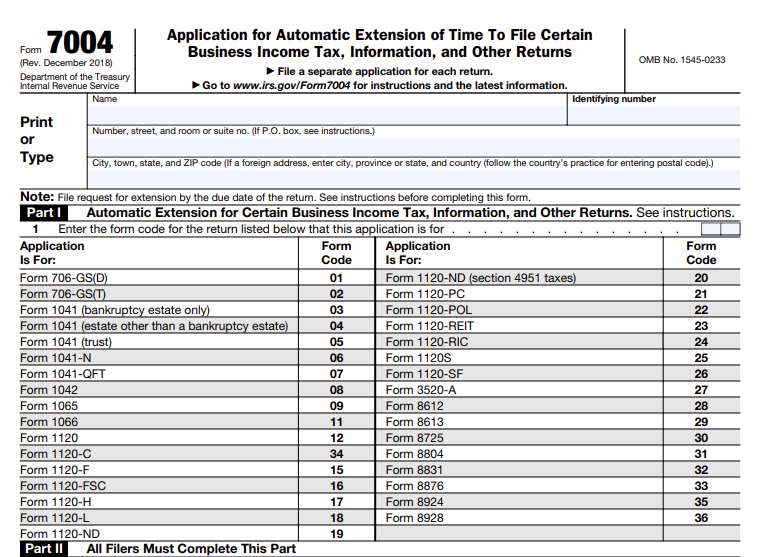

How to complete Form 7004?

-

Enter Basic Business Information

Legal Business Name, EIN, Entity Type, if applicable.

-

Choose Tax Form

Select the specific tax return for which you're requesting an extension (e.g., Form 1120, 1065, 1041).

-

Tax Period Details

Choose the tax period your Organization follows, whether Calendar or Fiscal tax year.

-

Tax Payment Details

- Businesses should enter the total tentative tax amount they owe.

- Enter the total payments you made or credits already applied

- Then enter the balance tax due and choose the payment method to pay your taxes you owe.

-

Additional Information

Short tax year? (If the business is filing for a short tax period, indicate the start and end dates.)

Foreign corporations? (Special rules apply for certain foreign entities.)

Visit https://www.expressextension.com/form-7004-instructions/ to know more about Form 7004 instructions.

Form 7004 can be filed electronically or on paper. However, the IRS recommends electronic filing for quick processing and provides you with the status instantly.

Get Started with ExpressExtension to e-file Form 7004 in Minutes!

Advantages of Filing Form 7004 with ExpressExtension

Easy and Secure Filing

Filing your extension form is easier than ever with our user-friendly interface and step-by-step instructions.

Copy Return

Already filed Form 7004 with us? Our system automatically generates your extension form from last year's filings.

Instant IRS Status Updates

Get instant email alerts about your IRS forms! Stay ahead in your tax process with real-time updates.

Get your Extension Approved or Money Back

If the IRS rejects your Form 7004 extension due to duplicate filing, we'll instantly refund your

filing fee.

Free Retransmission of Rejected Returns

If the IRS rejects your extension for any reason, we will inform you of the reason and assist you in correcting the errors.

Supports State Business Tax Extension

Easily fill out, download, and mail your state tax extension using the address we provide for your convenience.